- Contact Us Now: (703) 558-9311 Tap Here To Call Us

Estate Planning vs. Succession Planning vs. Asset Protection: Why Your Trust or LLC Is Not a Complete Plan (Virginia Guide)

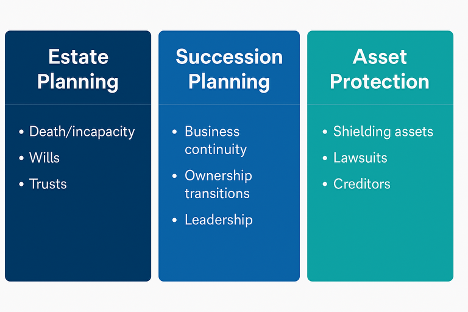

Many Virginia physicians and business owners assume that having a will, trust, or LLC means their estate is protected, their business is covered, and their assets are shielded from lawsuits. In reality, estate planning, succession planning, and asset protection are three entirely different strategies and mixing them up often leaves serious gaps.

This guide breaks down the differences in clear, practical terms so you understand what your current documents actually accomplish and what they do not.

1. Estate Planning: What Happens When You Die or Become Incapacitated

Estate planning answers one question: What happens if I die or lose the ability to make decisions?

A Virginia estate plan typically includes:

- Wills and trusts

- Powers of attorney

- Advance medical directives

- Probate and guardianship planning

These documents determine:

- Who inherits assets

- Who can act on your behalf

- How decisions are made during incapacity or after death

What Estate Planning Does NOT Do

Your estate plan does not:

- Govern how a business operates during life

- Decide who manages your business day to day

- Provide general protection from creditors or lawsuits

Estate planning is essential, but it is not a business strategy and not a liability shield.

2. Succession Planning: What Happens to the Business When an Owner Steps Away

Succession planning answers a different question:

What happens to the business when an owner steps away by choice or unexpectedly?

Succession planning focuses on:

- Who will control the business

- How ownership interests change during life

- How to preserve or transfer business value

Tools commonly involved include:

- Operating agreements

- Shareholder agreements

- Buy–sell provisions

Many Virginia business owners discover too late that:

- Their operating agreement says little (or nothing) about succession

- Their trust does not govern business operations

- Their estate plan does not solve governance issues

If your business lacks a clear succession plan, you are relying on luck, not strategy.

3. Asset Protection: Shielding Yourself From Lawsuits and Creditors

Asset protection answers a third and very different question:

What happens if something goes wrong while I am alive?

For physicians and business owners, risks often include:

- Lawsuits

- Creditor claims

- Business liabilities

Effective asset protection considers:

- How assets are owned

- How business and personal risks are separated

- Which legal structures reduce exposure

A few important clarifications:

- An LLC may limit certain business liabilities, but not all.

- A trust, by itself, does not guarantee creditor protection.

- Timing and legal structure matter especially in Virginia.

Asset protection works best when implemented before a claim or lawsuit appears.

4. Why People Confuse These Different Strategies

Estate planning, succession planning, and asset protection often get discussed together, which leads to widespread assumptions such as:

- “My LLC covers succession planning and protects my assets.”

- “My trust governs how my business runs.”

- “My estate plan protects me from risks during life.”

In reality, each tool solves a different problem and relying on one to do the job of another creates dangerous gaps.

5. The Real Risk: Thinking You Are Protected When You Are Not

Many high‑earning professionals and business owners in Virginia discover the truth only after a triggering event: death, disability, dispute, or lawsuit. By then, it’s too late to fix the gaps.

A trust is not a lawsuit shield.

An LLC is not a succession plan.

An estate plan does not manage your business.

A complete strategy requires all three areas working together.

6. How Seddiq Law Firm Helps You Protect Your Family, Business and Assets

If you are unsure whether your current will, trust, LLC, or operating agreement actually protects your family or business the way you think it does, you are not alone. Most clients discover critical gaps they didn’t know existed.

We help Virginia physicians and business owners by:

- Reviewing existing estate plans and trusts

- Analyzing LLCs and operating agreements

- Creating comprehensive succession plans

- Implementing proactive asset protection strategies

You deserve clarity, not assumptions.

Frequently Asked Questions

Does an estate plan protect me from lawsuits?

No. Estate plans control what happens at death or incapacity, not liability exposure. Asset protection is a separate strategy.

Does an LLC provide asset protection in Virginia?

An LLC may shield you from certain business liabilities, but it does not automatically protect personal assets or provide full lawsuit protection.

Does a trust control how my business operates while I am alive?

No. A trust may own business interests, but it does not govern operations. That is the role of an operating agreement or shareholder agreement.

Is a buy–sell agreement part of estate planning?

No. Buy–sell agreements are succession planning tools that control what happens to business interests during life events (retirement, disability, disputes, etc.).

Ready to Protect What You’ve Built?

If you are a Virginia physician or business owner, you need more than a will or trust.

You need a coordinated plan that addresses estate planning, succession planning, and asset protection together.

Call at (703) 558-9311, info@seddiqlawfirm.com; or click here contact us to schedule a consultation call to get clarity, close the gaps, and protect your family, your business, and your legacy.